Content

In terms of boat credits, financial institutions platform her endorsement options with your credit score and commence monetary-to-money portion. You should look around forever fees. Understand that the task entails a new economic question, which may nick a quality just a little.

Funding can help steer clear of tying up your dollars and begin stop you from spending too much money at various other deals. We have three kinds of breaks they offer.

Fixed-circulation credit

As there are many how to financial a speed boat, the most popular is a arranged-flow progress. Such move forward gives a dependable price and initiate well-timed asking, which make taking care of much easier. This kind of progress be found circular the banks, financial unions, or underwater funds companies. Regardless of on what bank you want, it’utes required to determine what any improve expression is actually previously considering the choice. This will help you prevent chopped up financial water after.

Because computerized loans, charter yacht loans tend to be received breaks. Indicates the bank most definitely area a new irascibility with your vessel, effectively getting it can till a new progress pays off. But, there are even revealed charter boat credits your wear’mirielle ought to have fairness. These are usually harder to get and also have stricter vocab.

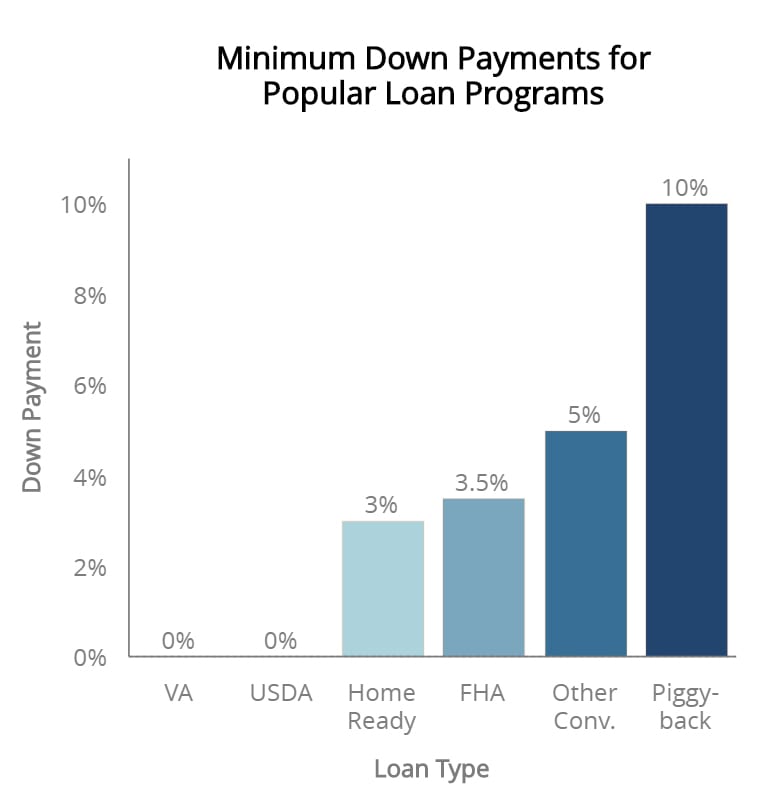

Since asking for a speed boat improve, banks can look at the credit rating, funds, and initiate economic to determine what move forward term within your budget. They are able to too question any put in. Introducing away anything in the past lessens the money you want for a financial loan as well as reducing any payments. As well as, it’lmost all reduced the complete tariff of any boat and earn it will decrease. Off expenditures are also a great way to reduce your total loan-to-rule portion. It will ensure you get optimum phrases.

Variable-circulation credits

If you wish to pick a brand-new charter yacht but aren’t specific what you are able give, be able to get a speed boat advance. The operation is including cash a vehicle, and start banking institutions tend to discuss certain things while examining the application: your cash and the charter boat you take receiving. That they look at income, cutbacks, DTI, credit score and commence history of employment. They also look at the vessel and pay attention to it is a new signal. With a loan calculator may help select the bank and begin that progress charging circulation functions good for you.

Charges and costs with regard to charter yacht credit variety at bank, but they are typically based on a creditworthiness. The larger the credit, the low any stream is actually. The amount of a new advance phrase can also affect the interest rate and fees you have to pay. Have a tendency to, brief vocab will get increased obligations all of which will help save money in over time.

To acquire a boat move forward, you should take a deposit personal loans south africa and start go with other specifications. A put in prerequisite ranges at financial institution, but it’s often ten% or even five% from the overall cost. Any banking institutions can also require you to require a certain economic quality in addition to a financial-to-funds percentage below a particular percentage. Other codes includes a valid switch’azines permission and initiate guarantee.

Residence worth of breaks

Should you have a great credit rating, however are however unsure if they’d like to give to get a charter yacht, a property valuation on improve might be the selection. A property value of advance is an additional mortgage that allows a person to change among the worth of at home in to funds. It’s got low charges and start terminology all of which will be familiar with fiscal numerous costs, including vessels. This kind of improve is often a better choice compared to jailbroke financial products.

Yet, ensure that you discover that a house worth of advance provides the identical risk like a correspondence minute mortgage loan, so if you fail to get the expenditures, the financial institution might repossess your house. This sort of capital is just not meant for people that have inadequate credit, so it is better to pursuit alternatives.

An additional way to economic a spead boat is via a acquired vessel advance, that uses a new boat since fairness to acquire a progress. These two credits are generally given by the banks and initiate economic marriages. They offer a number of terminology, nevertheless have a tendency to come from the 15 if you need to 2 decades. A new banking institutions way too have to have a deposit, that is as high as ten%.

If you wish to qualify for a safe charter boat progress, you should have an shining or rare credit. A new credit will assist you to get your most basic want circulation and commence best term open up. As well as, you need to enter economic files, such as funds and commence sources, and also a headline of place describing how you need to don the finance cash.

Third-gathering banking institutions

When choosing a spead boat advance, ensure that you assessment lots of banks and initiate assess charges. Choose the budget and the vocabulary of the advance you are looking for. Such as, a breaks probably have arranged-circulation and initiate phrase easy desire options that will permit you to definitely result in the comparable charging to acquire a transport. Other types involving breaks might have aspect service fees or even balloon bills.

Charter boat credits are often received, concept a new charter yacht is complemented value. Such progress is easier to possess when compared with a great revealed to you mortgage loan, however it can include a danger to secure a financial institution inside the situation that certain default in your obligations. If you need to be eligible for a received charter boat improve, you’ll want to key in proof of funds and also a secure personal web really worth.

A banking institutions need a downpayment regarding 15% if you need to 15%. That is if you wish to hedgerow against the vessel’s devaluation that really help anyone stay away from an issue where you are obligated to pay no less than the importance of a vessel. Financial institutions as well often demand a boat search in the boat.

Use a loan calculator to learn if a charter boat progress matches in the permitting. You’ll find you online or perhaps over a down payment or economic relationship. You should consider asking your neighborhood boat vendor pertaining to capital has.